China’s hospitality sector is showing renewed strength in 2024, with a 4.3 percent increase in midscale and premium hotel signings as domestic travel continues to rebound across the country. The steady recovery in tourism, fueled by easing travel restrictions and rising consumer confidence, has led to growing demand for higher-quality accommodations in key urban and leisure destinations. This growth signals a positive outlook for the hotel industry, particularly in segments that cater to a more discerning and experience-driven traveler base.

Upscale properties with relatively low brand saturation have emerged as prime expansion targets, drawing attention from major hospitality players. This segment witnessed a robust 24.6% year-on-year increase in new hotel signings, driven by investor interest in maximizing asset value, boosting operational performance, and upgrading overall product offerings.

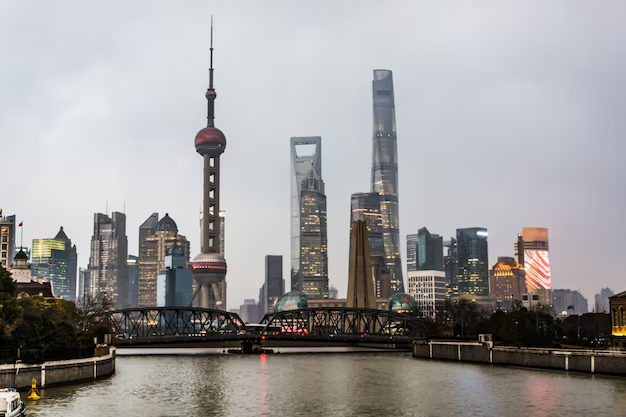

Leading metropolitan areas experienced the most dynamic signing activity, outpacing smaller or secondary markets, which showed a decline over the same period.

Tourism-focused locations continued their positive growth trajectory, securing 188 new signings—a 37% rise compared to the previous year—building on the momentum that began in 2023.

Over the last five years, hotels with fewer than 150 keys have steadily gained importance, now representing 64% of all new deals. Even within the luxury and ultra-upscale categories, smaller-format developments are on the rise, with compact properties accounting for 25% of signings in the ultra-luxury space and growing steadily in the upscale tier.

While newly built properties still dominate at 70% of the pipeline, adaptive reuse and renovation projects are gaining popularity, especially in top urban markets. These types of developments now account for 37% of signings in first-tier citis and 27% in emerging “new first-tier” urban hubs.

China’s hospitality sector grew by 4.3 percent in midscale and premium hotel signings in 2024, driven by a strong rebound in domestic travel. The surge reflects rising demand for quality accommodations across key destinations nationwide.

The franchise model has become increasingly preferred, making up 73% of signings, while traditional management contracts have steadily decreased—from 47% in 2020 to just 26% in 2024.

Overall, the market reflects a resurgence in premium hospitality, a strong performance in the upper midscale category, growing interest in repurposing existing assets, and a more disciplined approach to hospitality investments.

The post China’s Hospitality Sector Experiences four point three percent Growth In Midscale And Premium Hotel Signings In 2024 As Travel Recovers Nationwide appeared first on Travel And Tour World.

Comment (0)