In a stunning display of recovery and growth, Qatar has emerged as the dominant force in the Middle East tourism market, recording a remarkable 147% increase in arrivals during the first half of 2024 compared to pre-pandemic levels according to UN Tourism. Out of 120 destinations worldwide, 67 have managed to fully recover their 2019 arrival numbers, and Qatar leads the pack as one of the strongest performers, with arrivals more than doubling during the January-July 2024 period.

While Saudi Arabia is experiencing rapid growth with a 73% increase in tourism, driven by its ambitious Vision 2030, and Dubai in the UAE recorded an 11.4% increase in international visitors in the first half of 2024 compared to pre-pandemic levels, Qatar’s dramatic surge has set it apart from its regional competitors. Through strategic investments in luxury offerings, visa-free entry, and the ambitious National Tourism Strategy 2030, Qatar has outperformed both Saudi Arabia and the UAE, cementing its position as a global tourism leader.

Qatar Tourism:

Qatar’s tourism sector is a vital component of its economy, contributing significantly to GDP and employment while positioning the country as a global destination for leisure and business. The government has prioritized tourism as part of its economic diversification strategy, aiming to attract millions of visitors annually.

Strategic Goals

Looking ahead, Qatar has set ambitious targets to attract 6 million international visitors annually by 2030 as part of its National Tourism Sector Strategy. Several key initiatives are driving this progress:

Cultural and Sporting Events: Qatar has successfully leveraged events like the FIFA World Cup to raise its profile on the global tourism stage. These events not only bring in large numbers of visitors but also leave a lasting legacy for future tourism efforts.

Infrastructure Development: To support its growing tourism industry, Qatar continues to invest heavily in infrastructure, including new airports and advanced transportation systems. These developments are designed to enhance visitor experience and improve accessibility, ensuring that Qatar remains a convenient and attractive destination for travelers from around the world.

Qatar’s Major Airports

Qatar is stepping up its game in the tourism world, and its modern aviation network plays a big part in that. Hamad International Airport (DOH), based in Doha, is the country’s main hub. It connects 41 airlines to 116 destinations, and with its cutting-edge facilities and top-tier service, it’s often rated as one of the world’s best airports.

Then there’s Al Udeid Air Base (XJD) in Ar Rayyan. While it mainly serves military needs, it’s still a crucial part of Qatar’s logistics. These airports together show how Qatar is committed to keeping the world connected while boosting its own tourism industry.

Qatar’s Tourism Growth Strategy

Qatar’s tourism scene is booming, and it’s no surprise with the solid strategies they’ve rolled out to make it happen.

Strategic Partnerships and Campaigns

Qatar’s teaming up with its neighbors to bring in more visitors. One standout campaign is ‘Double the Discovery’, a collaboration with Saudi Arabia that invites travelers to explore both countries in one trip. With curated packages that highlight each country’s cultural and historical gems, this strategy adds an exciting twist to regional travel.

On top of that, stopover packages with Qatar Airways are drawing in people passing through. These packages let travelers get a taste of Doha, offering guided tours and airport assistance that make the layover experience even more enjoyable.

Events and Activities

Qatar knows how to throw a good event. The country keeps things lively year-round with festivals, family-friendly activities, and global sports competitions. Events like Thekra Night and the Qatar Toy Festival attract people of all ages. Plus, international draws like the AFC Asian Cup give the country even more global attention.

Infrastructure Development

Qatar is serious about building an environment where tourism can thrive. Recent projects like Msheireb Downtown Doha bring a fresh, modern edge to the city, while the Doha Metro ensures visitors can easily navigate. Sustainability is also a priority, as Qatar balances eco-friendly practices with its cultural heritage.

Marketing and Accessibility

Qatar’s tourism team is hard at work spreading the word. With global campaigns and partnerships with travel agencies, they’re making sure people around the world hear about Qatar. On top of that, the introduction of visa-free travel for citizens of 100 countries makes it even easier to visit.

Economic Impact

Qatar’s tourism industry has been thriving, with remarkable growth over the past few years. In 2023, the tourism sector contributed approximately QAR 81.2 billion to Qatar’s GDP, accounting for 10.3% of the total economic output. This represents a 31% increase from the previous year, underscoring the importance of tourism to the country’s economy.

The sector is also a major player in job creation, supporting around 286,000 jobs, which equates to one in eight jobs across Qatar. By 2024, this number is projected to rise to over 334,500 jobs, further solidifying tourism as a cornerstone of Qatar’s labor market.

Visitor spending has surged as well, with international tourists spending QAR 60.4 billion in 2023. Both international and domestic visitor spending are expected to see even greater growth in 2024, reflecting the sector’s robust and upward trajectory.

Visa-Free Policy: Expanding Global Accessibility

Qatar allows visa-free entry to citizens of 102 countries, making it easier for international tourists to visit and explore the country. This includes key markets like Australia, Canada, the United States, and several European nations such as Germany, France, Italy, and Spain. Citizens from China, including Hong Kong and Macau, alongside Japan, South Korea, and Russia, also benefit from visa-free travel.

Additionally, several Middle Eastern countries such as Bahrain, Kuwait, Oman, Saudi Arabia, and the United Arab Emirates enjoy visa-free access to Qatar. By streamlining entry for travelers from these important markets, Qatar is broadening its global reach and reinforcing its position as a leading destination for international tourism.

Qatar’s Hospitality Industry: Significant Growth Driven by Strategic Investments

Qatar’s hospitality industry is undergoing remarkable growth, bolstered by strategic investments and a focused approach to enhancing tourism. As part of Qatar’s National Tourism Strategy 2030, the country is positioning itself as a premier global destination, with significant developments underway to attract millions of visitors each year.

Growth Projections

Qatar’s hospitality sector is on a strong growth trajectory, with a compound annual growth rate (CAGR) of 11%. This will see the industry’s revenue rise from $0.9 billion in 2023 to $1.5 billion by 2028. Such growth reflects Qatar’s strategic investments in expanding its tourism infrastructure and its ability to draw in high-spending international tourists.

In addition to revenue growth, Qatar’s hotel market is set for a major expansion, with the number of hotel keys projected to grow by 89% by 2025, adding over 56,000 rooms. This expansion represents a $7 billion investment, further reinforcing Qatar’s commitment to offering world-class accommodations and luxury experiences.

Strategic Initiatives

Qatar’s National Tourism Strategy 2030 outlines ambitious goals, including attracting 6 million visitors annually and increasing tourism’s contribution to 12% of GDP by 2030. The strategy is centered on hosting high-profile cultural festivals and sports tournaments, with over 80 events planned for 2024 alone. These initiatives are designed to elevate Qatar’s visibility on the global stage while creating a diverse range of tourism offerings.

One of the standout developments in Qatar’s infrastructure plans is the Simaisma tourism project, a QR20 billion initiative that will feature multiple tourism zones, a theme park, and luxury amenities. Projects like this will not only expand Qatar’s tourism capacity but also enhance its appeal as a top-tier destination for leisure and luxury travel.

Market Dynamics

Qatar’s growing popularity as a tourist destination is reflected in its visitor statistics. In the first quarter of 2024, Qatar saw a 40% increase in passenger arrivals compared to the previous year. Alongside this, hotel occupancy rates jumped from 54% to 75%, signaling strong demand for accommodations.

A significant driver of this demand is the rising preference for luxury accommodations. With many of Qatar’s hotels positioned as four or five-star properties, the country is catering to the global trend toward personalized services and high-end travel experiences. This emphasis on luxury aligns Qatar with other top global destinations competing in the premium travel market.

Economic Impact

The economic impact of Qatar’s hospitality sector is expected to be substantial, with the industry contributing approximately $55 billion to GDP by 2030. As part of Qatar’s broader economic diversification efforts, the hospitality sector is playing a critical role in reducing the country’s reliance on energy revenues.

Additionally, Qatar’s HORECA (Hotel/Restaurant/Café) and F&B (Food & Beverage) sectors are projected to reach a value of $13.6 billion by 2026, further highlighting the growth potential of tourism-related industries. These sectors are set to create numerous employment opportunities and support the overall growth of Qatar’s economy.

Qatar’s Impressive Travel Recovery

In the first half of 2024, Qatar witnessed a remarkable 147% increase in arrival numbers compared to 2019. This surge demonstrates the country’s impressive recovery efforts, revitalizing its tourism sector after the pandemic. By focusing on enhancing visitor experiences, improving accessibility, and hosting high-profile events, Qatar has successfully drawn travelers back, reinforcing its position as a top destination for both leisure and business.

This strong rebound signals not only the effectiveness of Qatar’s strategic initiatives but also the growing global demand for travel to the region. The influx of tourists further boosts the local economy, supporting the nation’s goal of diversifying its economic base through a flourishing tourism sector.

Saudi Arabia’s Rapid Tourism Rise

While Qatar leads the Middle East tourism scene with an impressive 147% growth, Saudi Arabia is quickly emerging as a major contender. Through its ambitious Vision 2030 initiative, the Kingdom has experienced a 73% growth in tourism, according to the latest UN Tourism figures. This surge has drawn global attention and allowed Saudi Arabia to surpass the UAE, which has long been a dominant player in the region’s tourism industry.

Although Dubai continues to attract millions of visitors with its luxury shopping, world-class infrastructure, and renowned mega-events, Saudi Arabia is reshaping the tourism landscape by focusing on cultural tourism, religious tourism, and large-scale luxury developments. The Kingdom’s promotion of its rich cultural heritage, ambitious futuristic projects, and religious significance has widened its appeal, drawing a diverse, high-spending international audience.

Saudi Arabia’s rapid growth, while notable, still trails behind Qatar’s incredible surge. Both nations are investing heavily in their tourism sectors, but a closer look at their strategies reveals why Qatar is currently outpacing its neighbors, becoming a true global tourism powerhouse.

Vision 2030’s Role in Saudi Tourism

Vision 2030 is transforming Saudi Arabia’s tourism landscape. As part of this initiative, the government plans to attract 150 million tourists annually by 2030, a significant jump from the 100 million tourists welcomed in 2023—an impressive milestone achieved seven years ahead of schedule. Despite this growth, Saudi Arabia’s expansion is still catching up to Qatar’s faster-paced recovery and dominance.

Investment and Infrastructure Development

Saudi Arabia is investing nearly $1 trillion into its tourism infrastructure, with projects including the construction of 500,000 hotel rooms and flagship developments like NEOM and the Red Sea Project. These mega-projects aim to position Saudi Arabia as a luxury destination, competing with the UAE’s high-end tourism offerings while also posing a future challenge to Qatar’s well-established appeal.

The Red Sea Project alone will feature over 50 hotels and more than 8,000 rooms, creating a world-class destination with pristine leisure facilities and natural reserves. This emphasis on luxury accommodations plays a crucial role in Saudi Arabia’s rapid rise, though it has yet to match Qatar’s swift dominance in the region.

Diverse Tourism Offerings

Saudi Arabia’s growth is not solely focused on luxury. Vision 2030 also emphasizes expanding religious tourism, with a goal to increase Hajj and Umrah visitors from 10 million to over 30 million by 2030. This aspect of Saudi Arabia’s strategy appeals to a broader audience, particularly religious travelers, offering a unique advantage over other regional players. Still, Qatar’s multi-dimensional focus on cultural tourism and international events helps solidify its position as the leader in attracting diverse global travelers.

Saudi Arabia’s Diverse Tourism Offerings and Cultural Expansion

In addition to its rapid growth, Saudi Arabia is diversifying its tourism appeal with new luxury resorts like Amaala and Sindalah, as well as cultural heritage destinations such as Al Ula. Large urban developments, including King Salman Park in Riyadh, are designed to attract a broader range of visitors, from high-end luxury travelers to those interested in cultural exploration. This diversity gives Saudi Arabia a unique edge over the UAE, as it taps into multiple segments of the tourism market, allowing it to appeal to a wider and more varied audience.

Cultural and Entertainment Expansion

One of the most noticeable shifts brought about by Vision 2030 is the booming entertainment sector. Since 2017, Saudi Arabia has opened cinemas and hosted international events like music festivals—developments that were unimaginable in the past. The number of entertainment venues surged from 154 in 2017 to 227 in 2020, sparking increased interest from both domestic and international visitors.

This vibrant, dynamic entertainment scene contrasts with the more predictable offerings in the UAE, particularly Dubai. Saudi Arabia’s focus on creating a lively and youthful environment is becoming a key attraction, drawing in younger, more adventurous tourists who are seeking new experiences.

Visa-Free Policies

To further boost tourism, Saudi Arabia has introduced visa-free entry for citizens of 49 countries. This list includes countries such as Australia, Canada, the United States, and several European nations like Germany, France, Italy, and Spain. Citizens from China, including Hong Kong and Macau, alongside Japan, South Korea, and Russia, also benefit from visa-free travel. By making it easier for visitors from these key markets to enter the Kingdom, Saudi Arabia is widening its global reach, further supporting its goal of becoming a major player in international tourism.

Saudi Arabia’s Global Tourism Shift: Growth Across Sectors

Saudi Arabia’s transformation into a global tourism hub is not limited to leisure travel. The Kingdom is also seeing growth in business travel and religious tourism, which together are contributing to a significant rise in international visitor numbers. By relaxing visa restrictions, expanding its cultural and historical attractions, and investing heavily in religious tourism, Saudi Arabia is opening its doors to a much broader audience. This shift has not only diversified the tourism industry but also created substantial opportunities for global investors.

Spiritual Tourism: A Key Driver of Growth

One of Saudi Arabia’s strongest tourism assets is its religious significance, particularly the holy city of Mecca, which continues to be a major draw for millions of pilgrims. In 2024, more than 1.5 million foreign Muslims visited Mecca for the Hajj and Umrah pilgrimages. The Kingdom’s efforts to expand infrastructure around religious sites, including improving accommodation and transportation services, have made it easier for pilgrims to access these sacred locations. This emphasis on spiritual tourism remains a central pillar of Saudi Arabia’s overall tourism growth strategy.

Challenges on the Horizon

Despite the impressive advancements, Saudi Arabia faces several challenges. With 82% of new hotel developments focused on the luxury market, there are growing concerns about affordability for the average tourist. Industry experts suggest that more budget-friendly options are necessary to sustain long-term tourism growth and meet the ambitious goals of Vision 2030.

Additionally, Saudi Arabia’s infrastructure, while rapidly expanding, will need to keep pace with the growing influx of visitors. To avoid potential bottlenecks and service disruptions, continued investment in transportation and hospitality services is crucial.

Economic Impact of Saudi Arabia’s Tourism Growth

Tourism is becoming a vital part of Saudi Arabia’s economy. In 2023, the sector contributed approximately 11.5% to GDP and is projected to grow even further, potentially reaching SAR 836.1 billion by 2034. The tourism industry currently employs over 3.6 million people, and these numbers are expected to rise as the sector continues to grow. This economic boom not only positions Saudi Arabia ahead of the UAE in terms of tourism growth but also solidifies tourism as a key element of the Kingdom’s Vision 2030 diversification strategy.

Economic Goals and Investments

Saudi Arabia has ambitious economic goals to ensure tourism becomes a key driver of its national growth. By 2030, the Kingdom aims to increase tourism’s contribution to GDP from 4.5% to 10%, with a long-term target of reaching 16% by 2034. In 2023, the tourism sector contributed approximately 11.5% to the GDP, reflecting the significant progress already made toward these goals.

To support this rapid expansion, Saudi Arabia has committed over $800 billion to tourism-related projects, including the construction of 500,000 hotel rooms and the development of premier tourist destinations like NEOM, Diriyah, and Al Ula. These massive investments are vital to the Kingdom’s strategy to outpace the UAE and become the region’s top tourism hub.

Targeting Key Markets: Attracting High-Spending Tourists

Saudi Arabia has taken a more selective approach than its regional peers, focusing on attracting high-spending travelers from key markets such as China, India, and Europe. This emphasis on quality over quantity distinguishes Saudi Arabia from the UAE, which often targets mass tourism. By appealing to wealthier tourists, Saudi Arabia is avoiding the overtourism issues that more mature destinations face while cultivating an elite international audience.

By 2030, the Kingdom plans to increase international visitor numbers from 100 million in 2023 to 150 million, while encouraging these travelers to explore its cultural and natural treasures. This richer, more varied travel experience further distinguishes Saudi Arabia from the UAE’s focus on luxury and modernity.

Infrastructure Development: Building for the Future

Saudi Arabia is heavily investing in the infrastructure needed to support its growing tourism sector. Major projects include the construction of a new airport in Riyadh and the expansion of hotel accommodations across the country. One standout development is the Red Sea Project, a luxury tourism destination that will feature high-end resorts and leisure facilities catering to an elite clientele.

Additionally, Saudi Arabia is establishing a new airline and upgrading its transportation network to make international travel more convenient. These infrastructure investments are critical to making Saudi Arabia more accessible and competitive on a global scale, giving the Kingdom an edge over the UAE’s more established offerings.

Cultural Initiatives: Showcasing Saudi Arabia’s Rich Heritage

In line with Vision 2030, Saudi Arabia is promoting its rich cultural heritage to attract a diverse range of visitors. The Saudi Seasons initiative offers year-round cultural events, including festivals, concerts, and exhibitions, generating significant revenue and driving up visitor numbers. This initiative not only showcases Saudi Arabia’s cultural depth but also sets the Kingdom apart from the UAE, which tends to focus more on luxury and modernity.

Moreover, Saudi Arabia is opening its UNESCO World Heritage sites for tourism, offering travelers a glimpse into its authentic and historic landmarks. This focus on heritage and authenticity enhances the Kingdom’s appeal as a cultural destination, giving it a unique identity in the region.

Employment and Training: Preparing a Skilled Workforce

As tourism expands, so does the need for a skilled workforce. Saudi Arabia is addressing this by training 100,000 individuals annually for roles in the tourism sector, focusing on service quality and boosting local employment. This investment in workforce development not only ensures excellent service for visitors but also provides job opportunities for the Saudi population, making tourism a central pillar of the Kingdom’s economic diversification strategy.

Future Projections: A Bright Horizon

The future of Saudi Arabia’s tourism sector looks promising. According to the World Travel & Tourism Council, the sector’s contribution to GDP is expected to reach SAR 498 billion by 2024, with employment in the sector projected to hit 3.6 million jobs by 2034. Additionally, international visitor spending is anticipated to rise, signaling a robust recovery and ongoing expansion in the post-pandemic era.

Saudi Arabia’s Vision 2030 is transforming the nation into a global tourism powerhouse, with its investments in infrastructure and cultural promotion fueling a 73% growth in tourism, surpassing the UAE’s more gradual development. These strategic initiatives are not only attracting high-spending tourists but also positioning the Kingdom to compete as one of the world’s leading travel destinations.

Infrastructure Development: Luxury Accommodations Lead the Way

Saudi Arabia is setting the stage for a world-class tourism experience by focusing heavily on luxury accommodations. Out of the nearly $1 trillion allocated for tourism projects, a significant portion is being invested in the creation of 500,000 hotel rooms, with projections suggesting that between 150,000 to 200,000 new rooms could be added in the next two years alone. This places the UAE on notice, as Saudi Arabia’s emphasis on high-end offerings is positioning it as a serious contender in the region’s luxury tourism market. Notably, 82% of the new hotel developments are expected to be in the luxury segment, further cementing Saudi Arabia’s appeal to affluent travelers.

Key projects like the Red Sea Project—with plans for 50 luxury hotels along the country’s pristine coastline—and NEOM, a futuristic city filled with state-of-the-art leisure and hospitality facilities, are geared toward attracting the type of travelers who might otherwise choose the UAE. These developments are designed to showcase Saudi Arabia as a compelling alternative in the Middle East’s tourism scene.

King Salman International Airport: A Game-Changer for Saudi Arabia’s Tourism Growth

A significant part of Saudi Arabia’s Vision 2030 includes expanding its aviation infrastructure. The new King Salman International Airport in Riyadh is set to become one of the largest airports in the world. Once completed, it is projected to handle 120 million passengers annually, with plans to increase capacity to 185 million by 2050. This monumental development aligns with the Kingdom’s goal of becoming a global hub for travel and tourism, providing a major boost to connectivity and making Saudi Arabia more accessible to the growing number of international visitors.

Giga-Projects and Attractions: Cultural Heritage Meets Modern Tourism

Saudi Arabia’s tourism strategy isn’t just about infrastructure—it’s also about creating a unique blend of cultural heritage and modern tourism. The Kingdom is investing heavily in giga-projects like Diriyah, Qiddiya, and the UNESCO World Heritage site of AlUla, which offer tourists immersive cultural experiences that set the Kingdom apart from the UAE’s more modern and luxury-focused appeal.

One standout project is AlUla, which is expected to contribute 120 billion Saudi riyals ($32 billion) to the national GDP and create 38,000 new jobs by 2030. These ambitious efforts tie into Saudi Arabia’s broader vision of using tourism to boost the economy while celebrating its rich cultural past—factors that are propelling the Kingdom’s tourism growth.

Economic Impact: A Growing Force in Global Tourism

Saudi Arabia’s tourism boom is showing no signs of slowing down. In 2023, the Kingdom reached an important milestone by welcoming 100 million tourists, ahead of schedule. By 2030, the government aims to increase that number to 150 million, focusing particularly on attracting high-spending travelers from key markets like China, India, and Europe. This strategy, combined with the massive investments in infrastructure, is paying off, positioning Saudi Arabia ahead of the UAE in terms of growth potential.

Tourism’s contribution to GDP is expected to rise from 4.5% to 10% by 2030, a testament to the government’s commitment to making the industry a central pillar of economic diversification. The increased visitor spending, coupled with extensive job creation in the tourism sector, highlights how Saudi Arabia’s investments are transforming it into a leading travel destination.

AlUla: Saudi Arabia’s Cultural Crown Jewel

At the core of Saudi Arabia’s tourism success is AlUla, a region that seamlessly blends ancient history with modern luxury, attracting both domestic and international tourists. The Kingdom is actively promoting AlUla through several key strategies designed to compete with the UAE’s well-established tourism appeal.

Strategic Marketing Campaigns: Taking AlUla to the World

In February 2024, the Royal Commission for AlUla (RCU) launched the global marketing campaign “Forever Revitalising”, targeting high-potential markets like the UK, France, Germany, Italy, the US, China, India, and the GCC. The goal is to increase international visitor numbers from 35% to 45% by the end of 2024. This initiative reflects Saudi Arabia’s focus on reaching high-value travelers who seek unique cultural and natural experiences, distinguishing AlUla from the more modern attractions of the UAE.

The Royal Commission for AlUla aims to attract 291,000 visitors in 2024 and 380,000 by 2025, building on the 263,000 visitors recorded in 2023.

Infrastructure Development: Expanding for the Future

AlUla’s growth is supported by a strong infrastructure plan. By the end of 2024, the region plans to increase hotel capacity from 824 rooms to 1,300, with a longer-term goal of reaching 5,500 rooms by 2030 and 8,500 by 2035. New hotel openings, such as Dar Tantora The House Hotel and The Chedi Hegra, aim to draw luxury travelers looking for an authentic cultural experience.

In addition to hotel expansion, AlUla’s airport is undergoing significant upgrades, with the aim of boosting passenger capacity from 400,000 to 6 million annually. These enhancements will improve accessibility for international tourists, further supporting the Kingdom’s goal of making AlUla a world-renowned cultural destination.

Cultural and Historical Significance: An Open-Air Museum

What truly sets AlUla apart from other destinations in the region, including the UAE, is its cultural and historical significance. Home to Saudi Arabia’s first UNESCO World Heritage site, AlUla offers visitors a chance to explore ancient civilizations through archaeological sites like Hegra, which has over 200,000 years of history. The Royal Commission for AlUla is transforming the region into an open-air museum, preserving its natural and historical integrity while providing visitors with authentic, immersive experiences.

Economic Impact: AlUla as a Key Contributor

The development of AlUla is expected to contribute 120 billion Saudi riyals ($32 billion) to Saudi Arabia’s GDP by 2030 and create 38,000 jobs. This level of economic impact highlights AlUla’s importance in driving the Kingdom’s broader Vision 2030 goals, making it a crucial component in Saudi Arabia’s strategy to surpass the UAE as the region’s top tourist destination.

Partnerships and Collaborations: Enhancing Connectivity

To further enhance AlUla’s accessibility, the RCU has partnered with various airlines to improve connectivity, particularly with Europe and the US. Currently, charter flights make up 65% of all arrivals, emphasizing the Kingdom’s focus on attracting high-end tourists who value cultural and heritage experiences.

Dubai’s Tourism Growth in 2024: UAE’s Steady Expansion

While Saudi Arabia is experiencing a rapid 73% growth in tourism, Dubai continues to maintain its strong position in the global tourism market. In the first half of 2024, Dubai welcomed 9.31 million international overnight visitors, an 8.9% increase from the previous year. More notably, this represents an 11.4% increase compared to pre-pandemic levels in 2019, showcasing Dubai’s steady recovery and ongoing appeal as a top global destination. However, when placed side by side with Saudi Arabia’s dramatic surge, the UAE’s growth appears more measured.

Comparing Tourism Strategies: UAE vs. Saudi Arabia

Both Saudi Arabia and the UAE are making substantial investments in their tourism sectors, but their strategies and focus areas reveal key differences that define their unique paths to growth.

Tourism Infrastructure Development: UAE’s Established Base vs. Saudi Arabia’s New Giga-Projects

The UAE is widely recognized for its well-established, world-class infrastructure, with Dubai leading the charge through iconic hotels, resorts, and airports that serve both leisure and business travelers. The country’s developed transport networks make it an easily accessible destination for millions of international tourists.

On the other hand, Saudi Arabia is quickly closing the gap with its massive giga-projects like NEOM and the Red Sea Project, which are designed to position the Kingdom as a global leader in luxury tourism. While the UAE’s infrastructure is already well-established, Saudi Arabia’s focus on building state-of-the-art, futuristic projects brings a new and exciting dimension to regional tourism, offering fresh, modern experiences that cater to high-end travelers.

Diversification of Tourism Offerings: UAE’s Broad Appeal vs. Saudi Arabia’s Cultural and Religious Focus

The UAE has long relied on its broad appeal, offering everything from luxury shopping and beach resorts to cultural and eco-tourism experiences. This diversified approach ensures that Dubai attracts a wide range of visitors, from adventure seekers to high-end luxury tourists.

In contrast, Saudi Arabia places a heavier emphasis on cultural and religious tourism. The Hajj and Umrah pilgrimages are central components of its tourism strategy, with plans to significantly increase the number of religious visitors in the coming years. While the UAE boasts more modern and luxury-driven attractions, Saudi Arabia is leveraging its rich heritage sites like AlUla, drawing in tourists who are interested in historical and spiritual experiences.

Government Initiatives: UAE’s Well-Established Policies vs. Saudi Arabia’s Aggressive Promotion

The UAE government has consistently promoted tourism through reforms such as visa policies and marketing campaigns, ensuring that the country remains accessible and attractive to international visitors. Mega-events like Expo 2020 Dubai and ongoing cultural initiatives play an instrumental role in maintaining high visitor numbers and reinforcing Dubai’s reputation as a world-class destination.

In contrast, Saudi Arabia has adopted a more aggressive approach through its Vision 2030, which includes substantial investments in tourism and high-profile promotions aimed at boosting the Kingdom’s global appeal. This rapid push into the tourism sector sets Saudi Arabia apart from the UAE’s more gradual and steady efforts in promoting its well-established tourism industry.

Visa Free Policy: UAE’s Accessibility Advantage

The UAE has simplified travel for tourists by allowing visa-free entry to citizens of 55 countries, drawing visitors from a diverse range of nations across the globe. Among these countries are Argentina, Austria, Belgium, Brazil, and China, alongside several European Union member states such as Germany, France, Italy, and Spain. Additionally, visitors from Japan, Israel, and Mexico benefit from visa-free access, as do several Middle Eastern countries like Bahrain, Kuwait, and Saudi Arabia. Travelers from Switzerland, Norway, and Iceland also enjoy the UAE’s open visa policy, which forms a crucial part of its strategy to make the country more accessible and appealing to a broader international audience.

Personalized Travel Experiences: UAE’s Tailored Luxury vs. Saudi Arabia’s Emerging Luxury Market

The UAE has established itself as a leader in offering personalized travel experiences for high-net-worth individuals. From private beach resorts to customized cultural tours, luxury travelers in the UAE can enjoy exclusive, tailored experiences that meet their specific needs.

By contrast, Saudi Arabia is just beginning to develop its luxury market, with projects like Amaala and Sindalah targeting wealthy international tourists. While the UAE has long been renowned for luxury tourism, Saudi Arabia is offering new, unique experiences that appeal to a different kind of traveler, positioning its emerging luxury sector as a fresh alternative.

Sustainable Tourism Practices: UAE’s Established Eco-Tourism vs. Saudi Arabia’s Sustainable Development Goals

The UAE has been integrating sustainable tourism practices into its offerings for years, with a growing focus on eco-friendly travel options. Dubai’s eco-tourism sector includes desert safaris, nature reserves, and environmental conservation programs, attracting tourists who want to minimize their carbon footprint.

Meanwhile, Saudi Arabia is incorporating sustainability into its Vision 2030 development plans. Projects like the Red Sea Project are being designed with sustainability at their core, aiming to balance tourism growth with environmental preservation. While both nations are committed to sustainability, Saudi Arabia’s focus on sustainable development as it builds its tourism infrastructure is a standout feature of its growth strategy.

UAE’s Tourism Infrastructure Investments: A Steady Path to World-Class Experiences

As Saudi Arabia fuels rapid growth under Vision 2030, the UAE is taking a more established, yet ambitious, path to enhance its tourism industry. The UAE’s focus remains on expanding its already world-class infrastructure, ensuring it continues to be a global tourism hotspot. Both countries are making significant strides, but the UAE’s approach emphasizes steady, long-term growth over quick expansion.

Massive Investment Plans: UAE’s Strategic Commitment to Infrastructure

The UAE plans to invest over $10 billion in tourism infrastructure as part of its long-term strategy. These funds will support the development of new attractions, hotels, and other tourism facilities, reinforcing the UAE’s position as a premier travel destination. Unlike Saudi Arabia, which is building much of its tourism industry from the ground up, the UAE is expanding on an already well-established foundation.

In 2023, tourism investment in the UAE grew by 15.1%, with projections indicating an increase of nearly 12.5% in 2024. By 2034, total investments are expected to reach around AED50.9 billion ($13.8 billion). While Saudi Arabia is experiencing rapid growth, the UAE’s steady and calculated investments indicate a more sustainable approach to long-term tourism success.

Airport Expansions: Enhancing Connectivity

The UAE is also focusing on enhancing its airport infrastructure to accommodate growing tourism numbers. In the first half of 2024, UAE airports saw a 14.2% increase in passenger traffic, handling over 71.7 million travelers. This reflects the UAE’s established reputation as a global transit hub, a role Saudi Arabia is still building towards with projects like King Salman International Airport.

Hotel Construction: Expanding Capacity to Meet Future Demand

As part of its long-term vision, the UAE is focused on increasing its number of hotels and resorts to cater to the ever-growing demand. In Abu Dhabi, hotel rooms are set to increase from 34,000 to 52,000 by 2030. New hotel brands like Nammos and Mondrian are being introduced to attract both luxury and mid-range travelers.

While Saudi Arabia focuses heavily on luxury accommodations, the UAE is broadening its offerings to meet the needs of a wider range of tourists. This balance between high-end and more accessible options allows the UAE to continue appealing to a broad spectrum of visitors.

Attractions and Entertainment: A Blend of Culture and Adventure

The UAE’s diverse range of attractions continues to drive its tourism success. Major developments include the construction of the Guggenheim Museum, the expansion of Warner Bros World, the introduction of Harry Potter World, and enhancements to Yas Waterworld in Abu Dhabi. In Dubai, the lasting legacy of Expo 2020 and the ongoing success of Dubai Parks and Resorts reflect the UAE’s commitment to delivering world-class entertainment experiences.

By contrast, Saudi Arabia is placing more emphasis on cultural and heritage projects such as AlUla and Diriyah Gate, while also making strides in entertainment with projects like Qiddiya. The UAE’s diverse entertainment portfolio continues to appeal to both families and adventure seekers alike.

The UAE Tourism Strategy 2031: A Vision for the Future

All these developments align with the UAE Tourism Strategy 2031, which aims to attract AED100 billion in tourism investments and boost the sector’s contribution to GDP to AED450 billion by 2031. The goal is to position the UAE not only as a top destination in the region but as a world-class tourism hub. While Saudi Arabia is rapidly building its tourism future, the UAE is refining and enhancing its established tourism model.

Economic Impact of Tourism in the UAE: A Steady Growth Path Compared to Saudi Arabia’s Rapid Surge

The UAE has long been recognized for the significant economic contributions of its tourism sector. In 2023, the sector contributed 11.7% of the UAE’s GDP, amounting to AED220 billion, with this figure expected to rise to 12% (AED236 billion) by 2024. While these numbers reflect the UAE’s steady growth, Saudi Arabia’s rapid 73% growth under Vision 2030 is pushing the Kingdom towards a transformative period of development, giving it the potential to catch up quickly.

UAE’s Long-Term Investment in Tourism

The World Travel and Tourism Council (WTTC) projects that the UAE’s tourism industry will contribute around AED275.2 billion to GDP by 2034, underscoring the country’s commitment to fostering tourism as a major economic driver. Tourism investment in the UAE is projected to grow by 12.5% in 2024, following a 15.1% increase in 2023. By 2034, total investments are expected to reach AED50.9 billion ($13.8 billion).

Why Qatar is Beating Saudi and UAE

Qatar’s remarkable tourism growth, bolstered by a comprehensive strategy of investment, infrastructure development, and targeted initiatives, positions it as a dominant player in the Middle East’s tourism scene. With an impressive 147% growth in arrivals in the first half of 2024, Qatar has surged ahead of its regional counterparts, surpassing even long-established leaders like Saudi Arabia and the UAE.While Saudi Arabia is experiencing rapid growth under its Vision 2030 with massive infrastructure projects and cultural initiatives, and the UAE continues its steady expansion with world-class infrastructure and a diverse range of attractions, Qatar’s ability to attract high-spending tourists, develop cutting-edge luxury accommodations, and streamline travel through its visa-free entry policy sets it apart.

Although Saudi Arabia boasts high arrival numbers, especially under its ambitious Vision 2030 strategy, Qatar is outperforming both Saudi Arabia and the UAE in terms of growth percentage. Qatar’s ability to rapidly recover and grow its tourism sector highlights its competitive edge in the region.

The commitment to enhancing its tourism sector through initiatives like the National Tourism Strategy 2030 reflects Qatar’s long-term vision of establishing itself as a global tourism powerhouse. From high-profile cultural events and sports tournaments to state-of-the-art infrastructure projects like the Simaisma tourism project, Qatar is ensuring its growth continues at a rapid pace.

By focusing on both luxury travel and broad accessibility, Qatar is reshaping the regional tourism landscape, and with the hospitality sector projected to contribute $55 billion to GDP by 2030, the country’s dominance is set to continue. Qatar is not only setting the standard for tourism in the region but also demonstrating how strategic investments and forward-thinking policies can create lasting economic impact and global appeal.

Qatar: The Cultural Jewel of the Middle East

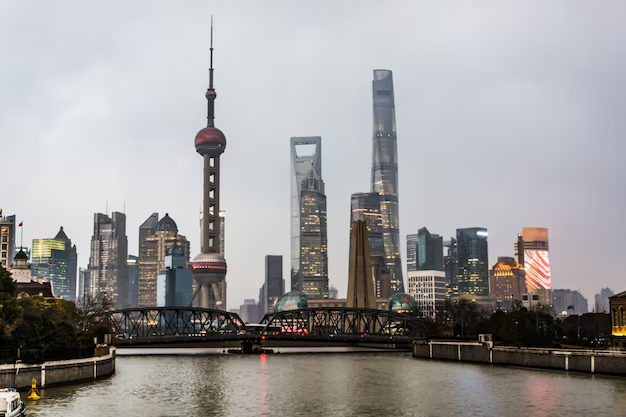

Doha:

As the capital city, Doha is a blend of modernity and tradition. Begin at the Museum of Islamic Art, a stunning structure housing centuries of art from across the Islamic world. Stroll along the Corniche, offering beautiful views of the city skyline and the sparkling waters of the Persian Gulf. The bustling Souq Waqif is a must-visit, where you can explore traditional Qatari culture through its spices, textiles, and handicrafts. For a futuristic experience, head to The Pearl-Qatar, an artificial island offering high-end shopping and dining.

Al Zubarah Fort:

Step outside Doha and visit Al Zubarah Fort, a UNESCO World Heritage Site. This historic coastal fort offers a glimpse into Qatar’s pearling past and provides insight into the region’s history and archaeology.

Desert Safari:

Qatar’s desert is another iconic attraction. Embark on a thrilling dune-bashing adventure or take a more leisurely camel ride. The Khor Al Adaid (Inland Sea) is a breathtaking natural wonder, where the desert meets the sea.

Saudi Arabia: Tradition Meets Modernity

Riyadh:

The capital of Saudi Arabia, Riyadh is a booming metropolis. Visit the Kingdom Centre Tower, where you can take in panoramic views of the city from the Sky Bridge. History buffs will appreciate Diriyah, a UNESCO World Heritage Site and the birthplace of the Saudi state, offering a peek into the rich past of the kingdom. The National Museum is another excellent stop for those interested in the history and culture of Saudi Arabia.

Jeddah:

This coastal city along the Red Sea is known for its cultural and historical significance. Wander through Al-Balad, Jeddah’s historical area, with its old coral houses and bustling markets. The Jeddah Corniche stretches along the coast, providing scenic spots to relax or enjoy water activities. Don’t miss the towering King Fahd Fountain, the tallest of its kind in the world.

Al Ula:

For a taste of Saudi’s ancient history, visit Al Ula, home to the Madain Saleh (Hegra), a UNESCO World Heritage Site. This ancient Nabatean city is filled with beautifully carved rock tombs and stunning desert landscapes.

UAE: A Fusion of Luxury and Tradition

Dubai:

Known for its futuristic skyline and luxury lifestyle, Dubai is a city of superlatives. Start your journey at the Burj Khalifa, the tallest building in the world, offering spectacular views of the city. Enjoy retail therapy at the Dubai Mall, one of the largest shopping malls globally, or head to the Mall of the Emirates for skiing in the middle of the desert. For a taste of tradition, visit the Al Fahidi Historical Neighborhood and learn about Dubai’s past at the Dubai Museum.

Abu Dhabi:

The UAE’s capital, Abu Dhabi, boasts a rich blend of cultural landmarks and modern marvels. The Sheikh Zayed Grand Mosque is an architectural wonder, with its massive white domes and intricate design. Explore Louvre Abu Dhabi, which houses an impressive art collection from around the world. For a taste of adventure, visit Ferrari World or stroll along the Corniche, offering stunning views of the city’s skyline and the Arabian Gulf.

Sharjah:

For a quieter, more cultural experience, Sharjah is the place to go. Known as the UAE’s cultural capital, Sharjah offers the Sharjah Museum of Islamic Civilization, which showcases thousands of Islamic artifacts. The Sharjah Art Museum is also worth a visit for contemporary art lovers. Explore the Heart of Sharjah, a restoration project preserving traditional Emirati architecture and culture.

The post Qatar Beating Saudi Arabia and UAE in the Middle East Tourism Sector with a Powerful 147 Percent Surge Rate appeared first on Travel And Tour World.

Comment (0)